…Expects to deliver growth potential of $20 billion in earnings and $30 billion in cash flow

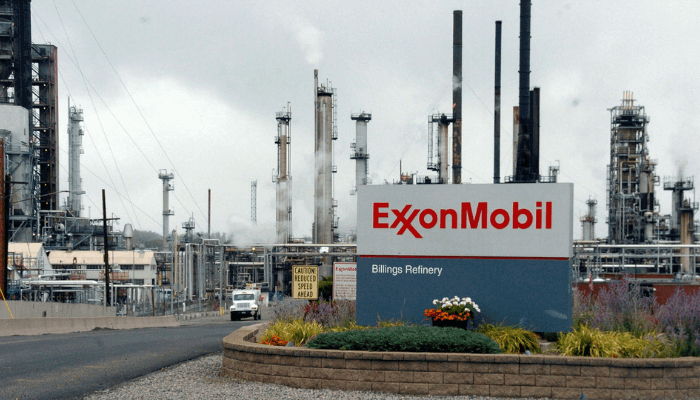

ExxonMobil today announced its Corporate Plan to 2030, creating a platform to further extend the company’s track record of delivering leading shareholder value. The plan reflects the company’s strategy to leverage its unique set of competitive advantages and unrivaled opportunities to create significant upside potential for shareholders. The company expects to deliver incremental growth potential of $20 billion in earnings and $30 billion in cash flow driven by investing in competitively advantaged opportunities, continued excellence in execution, and disciplined cost and capital management.1

“ExxonMobil has a unique set of highly valuable competitive advantages that equip us to do what few companies have ever done – create world-scale solutions to society’s biggest challenges, decade after decade,” said Darren Woods, ExxonMobil Chairman and CEO. “Our steadfast commitment to strengthening these advantages, including an unwavering investment in technology, has led to a history of innovative solutions that meet society’s critical needs, reduce costs, and grow high-value products. That’s a formula for profitable growth and shareholder value through and beyond 2030 – no matter the pace and scale of the energy transition – that truly puts us in a league of our own.”

Consistent execution of ExxonMobil’s strategy and business transformation over the past five years has substantially strengthened its earnings power. On a constant price and margin basis, the company is generating more than $15 billion in earnings and more than $20 billion in cash flow vs. 2019, and has delivered structural cost savings of more than $11 billion year-to-date vs. 2019. Cash flow has grown faster than that of any other integrated oil company (IOC) over the past three- and five-year periods. That outperformance has translated to shareholder value – ExxonMobil’s total shareholder return leads IOCs year-to-date and over the last three- and five-year periods.

Financial strength

Over the next six years, the company expects to generate an additional $20 billion in earnings potential and $30 billion in cash flow potential. It plans to grow earnings at a CAGR of 10% and cash flow at 8% and has plans to achieve an additional $7 billion in structural cost savings by simplifying business processes, optimizing supply chains, further enhancing maintenance turnaround processes, and modernizing information technology and data management systems.

The Company’s capital allocation approach prioritizes competitively advantaged, high-return, low-cost-of-supply investments. In 2025, the company expects cash capital expenditures to be in the range of $27 to $29 billion, reflecting the first full year of Pioneer in the portfolio and investment to build new businesses with base capex remaining flat. From 2026 to 2030, base capex is consistent, while capex growth is driven by progressing advantaged, long-term opportunities in new businesses, and a few early-stage large projects in the company’s traditional businesses. The reinvestment rate relative to expected cash flow declines 10 percentage points over the plan period.

“Through 2030, we plan to deploy about $140 billion to major projects and the Permian Basin development program,” added Woods. “We expect this capital to generate returns of more than 30% over the life of the investments. Strong investment returns have driven 42 consecutive years of annual dividend growth, a claim only 4% of the S&P 500 can make. This is why, when we list our capital allocation priorities, investing in accretive growth always comes first.”

Cash flow and earnings growth generate a further $165 billion in surplus cash over the plan period driving increased shareholder distributions. ExxonMobil has increased its annual dividend per share for 42 consecutive years, and recently increased its quarterly dividend by 4 cents per share effective this quarter. The company continues to expect to repurchase shares at a $20 billion annual pace in 2025, and today announced plans for a further $20 billion of share repurchases in 2026, assuming reasonable market conditions.

Upstream

ExxonMobil continues to strengthen its Upstream portfolio of advantaged assets that offer lower cost of supply and higher returns. By 2030, at a 2024 dollar real Brent price of $65 per barrel, a real Henry Hub price of $3 per mmbtu, and a real TTF price of $6.50 per mmbtu, the company plans to deliver an additional $9 billion in Upstream annual earnings potential – more than 50% higher than in 2024.

With the Pioneer acquisition, the company reached its target of having more than 50% of its total Upstream production from advantaged assets (Permian, Guyana, and LNG) three years earlier than planned. By 2030, more than 60% of the company’s production is expected to come from these advantaged assets, which are expected to grow by an additional 1.2 million oil-equivalent barrels per day (Moebd) during that period. Total Upstream production is expected to reach 5.4 Moebd by 2030, even as the company plans to lower its operated Upstream emissions intensity 40-50% versus 2016.

Following its acquisition and integration of Pioneer, ExxonMobil expects to achieve more than $3 billion in annual synergies, a more than 50% increase from prior guidance. The company now has the largest contiguous acreage position in the Permian Basin with double the number of low-cost net drilling locations versus the next closest competitor. The company is applying its technology advantage to increase capital efficiency and resource recovery and expects to roughly double production in the Permian Basin to approximately 2.3 Moebd by 2030.

ExxonMobil also announced plans for two additional developments in Guyana, Hammerhead and Longtail, bringing the total number of developments to eight by 2030. Total production capacity in Guyana, on an investment basis, is expected to reach 1.7 million barrels per day with gross production growing to 1.3 million barrels per day by 2030.

ExxonMobil has four world-class LNG projects under development and expects to surpass 40 million metric tons per annum of LNG sales by 2030. The addition of these projects further expands the company’s global LNG footprint and market access. The company expects to achieve first LNG sales from the Golden Pass development in the United States and from the Qatar North Field East expansion project near the end of 2025. It also is targeting final investment decisions at Papua New Guinea’s Papua project in 2025 and at Mozambique’s Rovuma development in 2026.

Product Solutions

ExxonMobil’s Product Solutions business is expected to grow annual earnings potential by an additional $8 billion by 2030, at average 2010-2019 margins – a 10% CAGR. About half of the earnings growth is expected to come from advantaged projects and high-value products to meet society’s needs today and well into the future.

The company is on track to start up six advantaged projects in 2025, as many as in the prior five years combined. These projects drive significant volume and mix improvements and include the China chemical complex; a hydrofiner in Fawley, U.K.; the Singapore resid upgrade project; a renewable diesel project in Strathcona, Canada; additional advanced plastics recycling units in Baytown, Texas; and an expansion of the ProxximaTM thermoset resin manufacturing facilities in East Texas.

ProxximaTM has unique properties that will drive substitution in existing markets and expand into new applications like structural composites and steel substitutes – areas where traditional resins struggle to compete. The company is investing in facilities to produce more ProxximaTM feedstock with plans to ramp up capacity to nearly 200,000 metric tons per year by 2030.

ExxonMobil also is growing its carbon materials venture to capture attractive opportunities in battery anode markets. ExxonMobil developed an advanced coke product that delivers a higher performance, differentiated graphite. The result is a battery with up to 30% higher capacity, 30% faster charging time, and extended battery life. The company is working with automobile manufacturers to test this new product, with plans to have its first commercial-scale plant online in 2028 to meet the growing demand for electric vehicle batteries and their components.

Low Carbon Solutions

ExxonMobil is pursuing up to $30 billion of low emission opportunities between 2025 and 2030, with almost 65% spent on reducing emissions for third-party customers. Execution of these opportunities is contingent on the right policy and regulation as well as continued technology and market development. ExxonMobil is pacing investments in new ventures to balance opportunities and risks as markets develop.

ExxonMobil’s Low Carbon Solutions business focuses on three primary verticals: carbon capture and storage, hydrogen, and lithium. These opportunities align with ExxonMobil’s core competencies.

The company is developing the world’s first large-scale carbon capture and storage system, which includes a high-capacity CO2 pipeline network connecting emitters from many industries to permanent subsurface storage capacity throughout the U.S. Gulf Coast.

ExxonMobil expects its low-carbon hydrogen facility in Baytown to be the world’s largest, producing up to 1 billion cubic feet of virtually carbon-free hydrogen per day with about 98% of the CO2 captured and stored. Some of this hydrogen will be used to produce over a million metric tons per year of low-carbon ammonia. The company is working toward a final investment decision in 2025 with the potential to start operations in 2029.

The company is building foundational projects that work with the right policy, today’s technology, and today’s infrastructure. At the same time, ExxonMobil is developing new technologies to reduce the cost of emission reductions, which is the only way to achieve deployment at scale. With a supportive policy and growing market interest, the company expects its Low Carbon Solutions business to grow earnings contributions by $2 billion in 2030 versus 2024.