Africa Oil Corp. has announced the completion of Africa Oil SA Corp.’s (AOSAC) strategic farm down agreement with TotalEnergies EP South Africa S.A.S. and QatarEnergy International E&P LLC. for the Orange Basin Block 3B/4B, offshore South Africa, announced on March 6, 2024. AOSAC is a wholly-owned subsidiary of Africa Oil. AOSAC has retained a direct 17.00% interest in Block 3B/4B and transferred the operatorship of the block to TotalEnergies.

Transaction Highlights:

- Maximum transaction value of up to $46.8 million to Africa Oil.

- Africa Oil will receive, subject to achieving certain milestones defined in the Agreement, staged cash payments for a total cash payment of $10.0 million of which $3.3 million is now due, and the remaining balance in two successive payments conditional upon achievement of key operational and regulatory milestones.

- Africa Oil will also receive a full carry of its 17.00% retained share of all JV costs, up to a cap, repayable to TotalEnergies and QatarEnergy from production in case of exploration success and development, which is expected to be adequate to fund the Company’s share of drilling for up to two wells on the licence.

Under a separate agreement between Africa Oil, AOSAC, Eco (Atlantic) Oil & Gas Limited and Eco’s subsidiary, Azinam Limited, signed in July 2024, AOSAC will acquire an additional 1.00% in Block 3B/4B from Azinam (“Eco Agreement”) subject to the satisfaction of customary conditions precedent, including approvals from the government of South Africa.

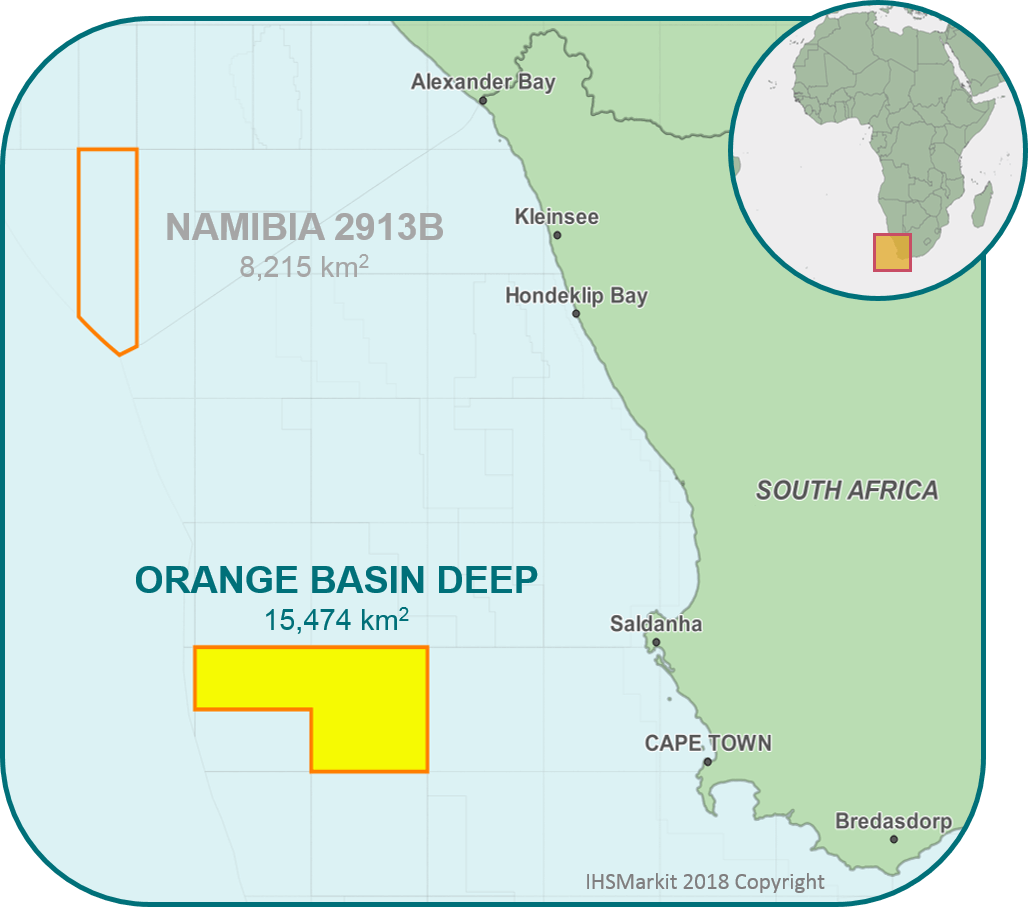

Africa Oil Chief Executive Officer, Dr Roger Tucker, commented: “Africa Oil has an unrivalled position amongst its Independent E&P peer group in the world-class Orange Basin. This includes our interest in the Venus discovery and the follow-on appraisal and exploration upside on Block 2913B, offshore Namibia. This farm down with TotalEnergies and QatarEnergy, two companies with deep geological knowledge of the basin, will facilitate exploration activities on Block 3B/4B, and extends our near-term scope for testing significant upside potential in our portfolio,” Africa Oil Chief Executive Officer, Dr Roger Tucker, commented.

About Block 3B/4B

Block 3B/4B covers an area of 17,581 km2 within the Orange Basin offshore South Africa in water depths ranging between 300m and 2,500m. This block lies to the southeast and on trend with number of oil discoveries including the Venus discovery. There is approximately 14,000 km2 of 2D seismic and 10,800 km2 of 3D seismic over Block 3B/4B and a large opportunity set of exploration prospects has been identified.

AOSAC has a 17.00% interest in Block 3B/4B (26.25% prior to completion of the Agreement) with TotalEnergies holding a 33.00% operated interest; QatarEnergy holding 24.00%; Ricocure (Proprietary) Ltd (“Ricocure”) holding 19.75%; and Azinam holding 6.25%.

On the completion of the Eco Agreement, which is subject to the satisfaction of customary conditions precedent, including approvals from the government of South Africa, the interests in Block 3B/4B will be comprised of: 18.00% held by AOSAC; 33.00% held by TotalEnergies; 24.00% held by QatarEnergy; 19.75% held by Ricocure; and 5.25% held by Azinam.

Eco Agreement

In July 2024, Africa Oil and AOSAC signed the Eco Agreement with Azinam, pursuant to which Azinam has agreed to sell and assign a 1.00% interest in Block 3B/4B to AOSAC in exchange for the cancellation of all common shares in Eco and warrants over Eco common shares held by Africa Oil. The Company holds 54,941,744 Eco shares and 4,864,865 in Eco warrants, combined constituting approximately 16% of the total securities in Eco and also constituting the entire security holding of Africa Oil in Eco. Through its current shareholding in Eco, Africa Oil has an indirect 0.93% interest in Block 3B/4B

In the same vein, ECO has announced the completion of a farm down of a 13.75% Participating Interest in Block 3B/4B offshore South Africa and Transfer of Operatorship of the Block to TotalEnergies, who will become the operator, and QatarEnergy. Eco now holds a 6.25% interest in Block 3B/4B.

Gil Holzman, CEO of Eco: “I am grateful to the Eco team and our advisors for their support in completing this transaction. We look forward to continuing our strong working relationship with all the JV partners, the South African Government, and the new Operator TotalEnergies.

Block 3B/4B sits in a prolific hydrocarbon jurisdiction and we are excited to continue preparations for first drilling on the block under the leadership of TotalEnergies. “Completion of the transaction further strengthens Eco’s balance sheet and enables us to focus and continue progressing our wider work programmes and farm out processes in Eco’s asset portfolio in Guyana and Namibia, with no shareholder dilution.”