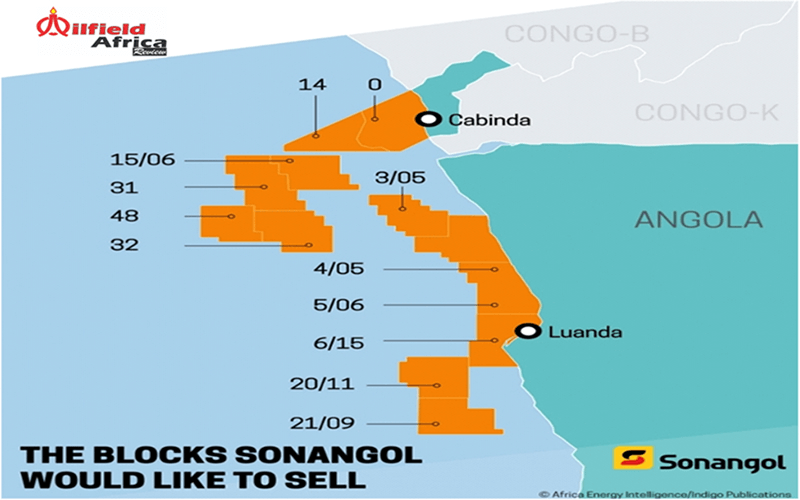

Afentra plc has disclosed that the company has completed the acquisition of a 12% non-operating interest in Block 3/05 and a 16% non-operating interest in Block 3/05A offshore Angola . This is pursuant to the sale and purchase agreement between Azule Energy Angola Production B.V. and Afentra's wholly-owned subsidiary, Afentra (Angola) Ltd, announced on the 19 July 2023.

The Azule acquisition has increased Afentra's interest in Block 3/05 to 30% and in Block 3/05A to 21.33%. The Payable cash consideration at completion is $28.4million. Initial cash consideration of $48.5m was reduced by impact of cash flow adjustments as of the transaction effective date of 1 October 2022

The Company inherited initial crude oil stock of 480,000 bbls , but at completion the crude oil stock is expected to rally to around 840,000 bbls While Net Debt is expected to be $46.2m. The Company is expectd to sell its next cargo of crude oil totaling 450,000 bbls in June 2024

Production Update

Combined gross production for the first four months of 2024 ending 30 April 2024 for Blocks 3/05 and 3/05A has averaged ~23,000bopd (Net: ~6,800, bopd). The Light Well Intervention programme, commenced by the joint venture during 2023, continues into 2024 with a further 45 interventions planned over two campaigns.

Annual Results 2023

The Company and it's auditor, BDO, continue to review and audit the appropriate accounting treatment relating to the INA and Sonangol acquisitions completed in 2023. The Company expects this work to be completed and the annual results issued in early June.

"The completion of the Azule Acquisition is the final step in the complex process of acquiring a material equity position in both Block 3/05 (30%) and Block 3/05A (21.33%) through three separate transactions. We have now achieved our first goal of having significant exposure to these world-class production and near-term development assets. The next step, working closely with our Joint Venture partners, is to deliver the full potential of these assets for the benefit of all of our stakeholders while also reducing the carbon footprint of the assets.

As with the previous two transactions the acquisition structure ensures that Afentra benefits from the net cash flow from the assets while working through the completion process, significantly reducing the cash payment at completion. I would like to thank Azule, ANPG and all the other parties involved for their pragmatism and support through this complex process.

The Block 3/05 asset continues to perform strongly following the successful implementation of an ongoing work programme designed to optimise production from the existing wells. The completion of this transaction presents a strong growth platform for Afentra to capitalise on further compelling opportunities in Angola as well as in target markets in West Africa as we seek to build Afentra into a leading African focused independent," Commenting on the update, CEO Paul McDade said.