In recent years, Namibia has emerged as one of the most significant focal points for oil and gas exploration in Africa, driven by a surge in exploration activities and the increasing presence of major international oil companies (IOCs). The country’s attractiveness as a destination for exploration and production (E&P) campaigns is largely attributed to its supportive governmental policies and investment-friendly environment. These factors have positioned Namibia as a promising frontier in the global energy sector, drawing considerable international interest.

One of the key areas underpinning this surge in activity is the Orange Basin, a prolific geological formation that has been the site of several major hydrocarbon discoveries, including the highly publicised Venus and Mopane finds. These discoveries have bolstered Namibia’s reputation as an emerging oil and gas hub, significantly enhancing its global credibility among investors and industry stakeholders.

A critical element in fostering this investment climate has been the introduction of progressive policies such as the Investment Promotion Act (2016). This legislation was specifically designed to stimulate and facilitate foreign direct investment in priority sectors, including the oil and gas industry. By reducing regulatory and operational barriers for IOCs, this framework has created a more conducive environment for large-scale energy projects, thereby accelerating exploration and development efforts.

The recent election results, which saw the continued leadership of the SWAPO party and the historic election of Netumbo Nandi-Ndaitwah as Namibia’s first female president, have introduced new dynamics to the country’s energy landscape. While the administration remains committed to advancing the nation’s energy agenda, it also faces immediate challenges related to the ongoing activities. The effectiveness of the new government’s policies in managing these challenges will be closely observed by industry players and investors alike.

According to EICDataStream, over the next two years, two significant projects have received schedules for reaching Financial Investment Decisions (FID). The first of these, TotalEnergies’ Venus project, is anticipated to reach the decision by December 2026. Meanwhile, the Kudu Gas Field Project, spearheaded by BW Energy, is expected to attain FID approval within the first half of 2025. These developments reflect a concerted effort to advance key energy initiatives in alignment with industry objectives and investment strategies.

Among the most significant discoveries in the Orange Basin is TotalEnergies’ Venus field, which has been described as a giant for the country’s upstream sector.

The Venus-1X well, drilled in 2022, confirmed a substantial light oil reservoir, with further appraisal wells reinforcing the basin’s high potential. Given its scale, the Venus discovery is expected to attract significant development investments and could lead to Namibia’s emergence as a major oil-producing nation. The project’s development design will encompass an FPSO with a production capacity of 160,000 barrels of oil per day (bopd) and 500m cubic feet per day (MMcfp/d). The outcome of the Venus field’s appraisal and commercial viability will play a pivotal role in shaping Namibia’s future as an oil-producing jurisdiction.

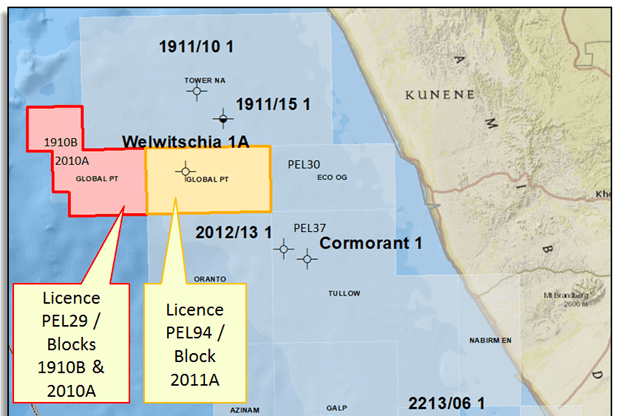

Another relevant player is Galp and its Mopane discovery, which has garnered significant attention due to its rapid pace of development. Following a series of successful E&A operations, the FID for full-field development may be imminent. Recent discoveries at Mopane-2A, including gas-condensate in AVO-3 and light oil in AVO-4, have prompted the company to proceed with Mopane-3X, which targets two additional prospects. The results of this drilling campaign are eagerly awaited, as it could have significant implications for the basin’s overall hydrocarbon potential.

Furthermore, the international oil and gas community is closely monitoring the anticipated farm-out agreement, which is expected to materialise by Q4 2025/Q1 2026, according to the company. Among the companies expressing interest, Brazil’s state-owned oil company Petrobras has publicly declared its intention to enter the Namibian market as an operator. This move aligns with Petrobras’ broader strategic plan to expand its footprint in Africa, reflecting the growing international recognition of Namibia’s energy potential.

Despite the country’s recent success and impressive results, it has recently seen a potential development obstacle. Reports indicate that Shell’s discoveries – Jonker, for example – are currently not financially viable for development. However, the energy giant has reaffirmed its commitment to Namibia, stating that it will not exit the country and plans to conduct further studies to enable future exploration. While Shell remains dedicated to advancing its discoveries, it has applied for a US$400m write-off, marking the first significant setback in Namibia’s oil and gas ambitions.

As exploration and development efforts continue to progress, Namibia’s role in the global oil and gas industry is set to strengthen, presenting both opportunities and challenges for investors, policymakers and stakeholders. The coming years will be crucial in determining the country’s long-term success as a major hydrocarbon producer.

Written by Guilherme Martins, Energy Analyst (Oil & Gas) – Europe & Africa